5 Reasons to Invest in Short-Term Property Rentals

5 Reasons to Invest in Short-Term Property Rentals

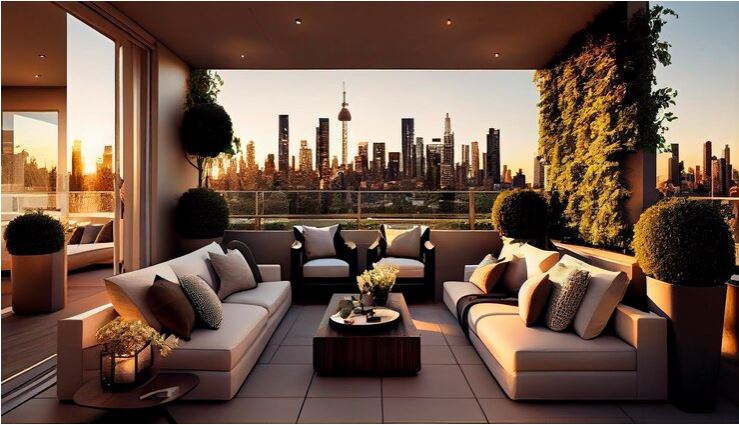

Short-term property rentals has become an increasingly attractive option for individuals looking to capitalise on the dynamic and ever-growing hospitality market in the realm of real estate investment.

From apartment buildings in the city to dream vacation homes, the irresistible draw of short-term rentals persistently lures investors worldwide.

1. Lucrative Income Potential

Short-term property rentals can be a great source of income, and the best part is that it will work especially well in popular locations.

In the case of high-demand city centers or popular tourist destinations, quick visits come at premium prices and generate significant incomes.

You can adjust the rent price by seasons or demand in the market hence raising profits. This also makes short-term rentals the number one choice for those pursuing high returns.

2. Diversification of Investment Portfolio

Short-term property rentals bring variety to your real estate investments. Unlike the long-term leases, these provide an alternative to risk mitigation and profit enhancement.

It targets the expanding temporary accommodation market. Therefore, you can minimize the fluctuations of markets while leveraging a stable hospitality industry.

3. Flexibility and Personal

Flexibility, for personal use is one of the most important advantages that come with owning a short-term rental property.

Investors can time their occupancy period while renting out the property for part of the remaining.

This combination of pleasure and profitability brings a level of flexibility that is usually missing from long-term lease arrangements, making short-term rentals an attractive solution for people who want to combine investment with lifestyle.

4. Market Trends Adaptability

The responsiveness of short-term property rentals to market trends and consumer needs is a critical strength for investors.

Considering the ability to quickly change rental rates, focus on particular population groups and benefit from emerging travel trends, short-term properties have all chances of riding well with changing hospitality market dynamics.

Such adaptability allows the investors to adjust their assets according with changing demands thus securing relevance and profit in a constantly mutating environment.

5. Availability of Technology and Rental Platforms

Technology and online rental sites has made things very easy for the management of short-term rentals.

As a result, investors can utilize technology to allow for streamlined booking systems as well as digital marketing tools that enable them efficiently market their property, manage reservations and ultimately increase occupancy.

The platform’s availability makes it possible to get a wide range of investors so that the latter can benefit from an extensive client base and ensure high visibility for their rental property under intense competition in the hospitality sphere.

Conclusion

To conclude, there are several aspects attracting property owners to short-term rentals: income generation opportunities; diversification benefits; high flexibility and adaptability to changing market conditions enabling utilization of technology driven rental platforms.

With the hospitality industry ever changing, investing in short term rentals present a great opportunity for anyone looking to venture into real estate investment and realise returns from temporary accommodation.

Frequently Asked Questions (FAQs) about Short-Term Property Rentals:

1. Why consider short-term property rentals over long-term leases?

Short-term property rentals offer lucrative income potential, especially in popular locations with high demand.

This flexibility allows for adjusting rental prices based on seasons or market demand, providing investors with the opportunity for high returns.

2. How do short-term property rentals contribute to diversifying my investment portfolio?

Unlike long-term leases, short-term rentals bring variety to your real estate investments.

They provide an alternative for risk mitigation and profit enhancement, targeting the expanding temporary accommodation market and minimizing market fluctuations.

3. What advantages does personal flexibility offer in short-term rentals?

Short-term rentals offer the flexibility of personal use, allowing investors to time their occupancy periods while renting out the property for the remaining time. This unique combination of pleasure and profitability is often missing from long-term lease arrangements.

4. How do short-term property rentals adapt to market trends?

Short-term rentals exhibit adaptability to market trends and consumer needs.

With the ability to quickly change rental rates, focus on specific population groups, and align with emerging travel trends, investors can navigate the ever-changing hospitality market dynamics.

5. How does technology play a role in managing short-term rentals?

Technology and online rental platforms have streamlined the management of short-term rentals. Investors can utilize digital tools for efficient marketing, managing reservations, and optimizing occupancy.

This technological advantage enables investors to reach a broad client base and ensure high visibility in a competitive hospitality market.

6. Why should I consider short-term rentals in the current real estate market?

Short-term rentals present a compelling opportunity for property owners due to various factors, including income generation, diversification benefits, flexibility, adaptability to market conditions, and the availability of technology-driven rental platforms.

With the hospitality industry evolving, short-term rentals offer a chance for profitable real estate investments in temporary accommodations.

For more information visit: Silk Valley Holiday Homes